As part of the recently passed Consolidated Appropriations Act of 2023, (commonly referred to as SECURE Act 2.0), retirees have an exciting, new opportunity: to make a donation to a qualified 501(c)(3) organization directly from their IRA (referred to as a Qualified Charitable Distribution or QCD) while also establishing a Charitable Gift Annuity (CGA) which will pay them a fixed income for life.

To benefit from this new opportunity, the following is required:

- A donor may establish a CGA with a QCD in only one tax year during their lifetime.

- The donor must be 70.5 or older.

- The maximum funding amount is $50,000. A married couple can each donate up to $50,000 from their respective IRAs for a total of $100,000. Spouses can establish their CGAs in separate years.

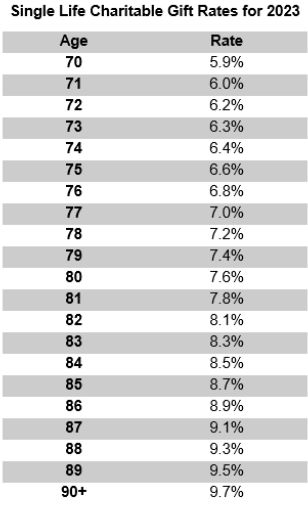

- In exchange for the gift from your IRA, the charity will make a fixed annual payment to you. The payment amount is based on your age and whether you would like the payment to continue for your lifetime or for a joint lifetime (for both spouses).

- Your distribution will count towards your Required Minimum Distribution (RMD) in the year in which you make the gift.

- The annual income you receive from the charity will be taxable to you. The income is a fixed amount each year which is based on your age when the gift is made.

- There is also a joint life rate chart that takes into consideration the age of both spouses.

An example: Beth is 71 and she decides she would like to make a QCD to the Red Cross and she would also like to take advantage of the new rules allowing her to receive income for life. Beth sends $50,000 from her IRA directly to the Red Cross. Beth has a total Required Minimum Distribution this year of $43,000. This gift will count towards, and cover, the entire amount of this year’s RMD. Since she makes the gift when she is 71, she will receive a fixed payment from the Red Cross each year for $3,000 (6% payout rate for age 71). Beth has managed to significantly reduce her taxable income this year by not having to pay tax on her $43,000 RMD, but she will need to pay tax on the $3,000 she receives each year moving forward from the Red Cross.

This could be an attractive way to donate funds to a charity, particularly for people who 1)have most of their assets in IRAs, 2) would like to reduce the tax impact of their RMD, and 3) would also benefit from receiving a fixed annual income from their donation.