Question: The possibility of a recession and the potential debt ceiling crisis really has me worried. Should I make a change to my portfolio?

Answer: We understand you might be worried about what you’re seeing in the news and conversations you’re having with friends. If you are concerned, we hope you find solace in the fact that everyone has access to the same information – which is actually good news! This means the information in question is already reflected in the price of stocks and bonds. So this leaves two ways to approach the question “Should I make a change?”

1. “I can’t take it anymore. I’m reallocating away from stocks to cash!” If this is your approach, you are taking a gamble. We call this the ‘casino strategy.’ In other words you’re saying: “I’m pulling out of the market and making two bets: that I can get out of the market prior to a downturn and that I can re-enter the market prior to the recovery.” There is a tremendous amount of stress and anxiety that goes along with this kind of approach. And unfortunately, like a casino, the odds are stacked against you, as you’ll see below.

2. Let’s think about the other approach: “I have an advisor, a plan, and 90+ years of data that tells me I should be consistent with my investment approach even during times of uncertainty. I have an economic framework that allows me to be disciplined and stick with my plan.”

The second approach is how we need to think about events like recessions, debt ceiling limits, and other crises. If it’s already reflected in the price, there’s nothing we can do about it except to make a short-term bet. Rather than gambling, we recommend making a better, longer term decision.

Market Returns vs Betting

The blue line in the graph below shows the market return of the Russell 3000 (a US stock market index) from the past three years. The return average over this time period was approximately 7% per year.

The yellow line shows cash flow in and out of the market. This line demonstrates investors employing the ‘casino strategy.’ You can see for most of 2020 investors were continuously selling. Finally, toward the end of that year, investors started to buy into the market again. But if you look at the blue line, you can see the market in 2020 was already going back up for a good while before investors started to buy back in. The disconnect between the two lines amounts to a significant amount of gains missed by people placing bets.

Over the entire time period shown, you can see the yellow line is just to the right of what the market is actually doing. ‘Casino strategy investors’ acted with a 3-6 month delay after the market moved. This means they were selling after the market went down, and they were buying after the market started going up. In a perfect world those “sells” would take place before the market drops and those “buys” would take place before the market starts going up. But that doesn’t work because no one has a crystal ball to predict the future.

So, how we answer “should I make a change” is the difference between the ‘blue line’ which is growing wealth despite the ever turbulent nature of economics and politics, and the ‘yellow line’ which sadly is destroying wealth.

It doesn’t have to be this way. The highest chance of investing success is to stay disciplined and allow the capital markets to provide a good rate of return over time.

Recession… Are We There Yet?

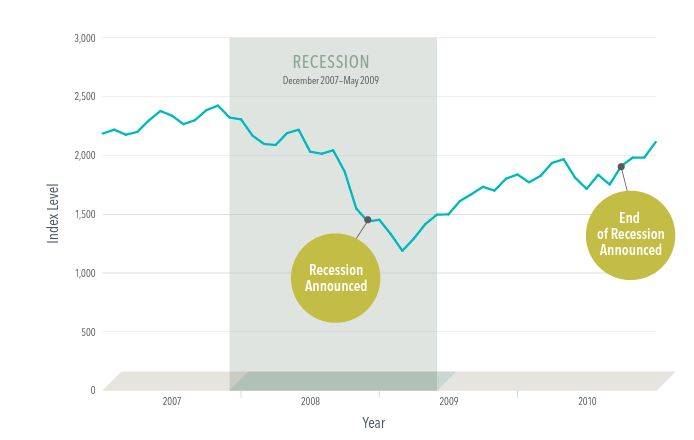

Okay, but what about the possibility of a looming recession? Here’s a graph from the 2008-2009 Great Recession that we think provides some clarity. An incredible amount of data is needed for economists to be able to officially announce a recession. Because of this, throughout past economic cycles, by the time a recession is announced, it is well on its way to being over. The same thing happens with the announcement of the end of a recession. By the time the end is declared, we are typically already deep into a bull market.

The Debt Ceiling… To Default or Not To Default? That Is The Question.

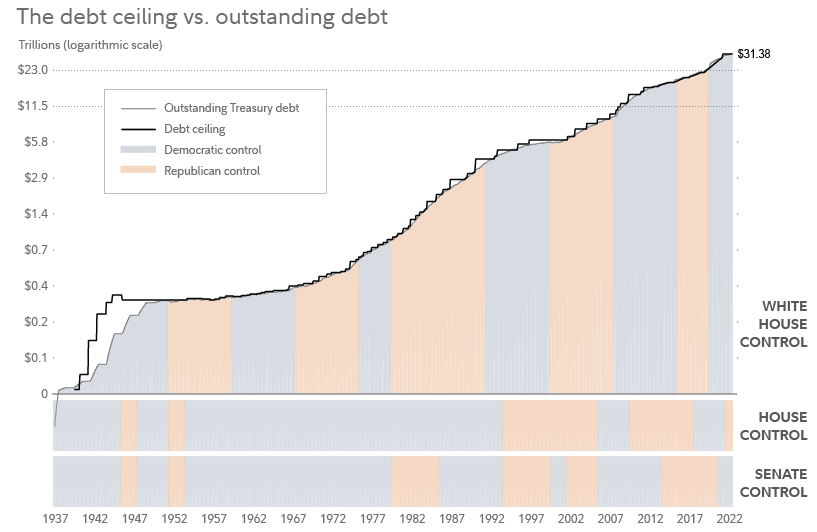

Sure, discussions of debt and default sound concerning, but we think it’s important to note that history shows deficit spending is not a partisan issue. Both Democrats and Republicans have overseen increases to the country’s debt balance. The chart below shows the debt ceiling limit versus outstanding debt and how that correlates to control of the executive and legislative branches of government. As for the current negotiations in Congress, episodes like the present have happened in the past and undoubtedly will happen in the future. While there could be some short-term consequences, we are disciplined long-term investors and history tells us things that feel big in the moment, eventually sort themselves out, often sooner and with less turmoil than we anticipate. Our advice: we do not recommend employing the ‘casino strategy.’

A Bird’s Eye View

When 2023 is gone, these events will all become part of the market cycle history and will be reflected in future graphs and charts that we will analyze and review to ease our worry of the inevitable future economic and market concerns. The bottom line: there will always be factors beyond our control that will impact the markets. Disregarding the daily and even yearly fluctuations is paramount. History tells us that resisting the urge to place bets, and instead employing a disciplined strategy, is the magic bullet to successful investing.