The topic of inflation is impossible to avoid these days whether you are witnessing increasing prices of goods at the store or reading about inflation in the news on a daily basis.

To compound matters, the stock market is down nearly 20% in value since the beginning of 2022 and the bond market is down nearly 10% in value. From an investment perspective, these are the crucial time periods in which the decisions you make as an investor, while not easy, will have a big impact on your portfolio’s long-term results.It’s wise to:

- Stay consistent with your investment allocations.

- Make no major changes in your portfolio based on any future predictions or recent market trends.

- Take advantage of opportunities that are presented at a time like this, such as rebalancing your portfolio and tax-loss harvesting.

When it comes to investing, “staying the course” and not making major changes is the prescription for success.

However, when it comes to INFLATION there is an important step you can take, so read on for what you can do.

Inflation in 2022: How we got here

- The global pandemic has caused many supply chain issues which have disrupted the production and output of many goods. This has led to higher prices.

- In recent years, the Federal government has pumped excess money into the US economy which has led to more money trying to buy fewer goods.

- The war in Ukraine has placed high stress on global energy markets and disrupted pricing.

- Note for some perspective: prior to 2021, the US had 9 consecutive years of below-average inflation rates.

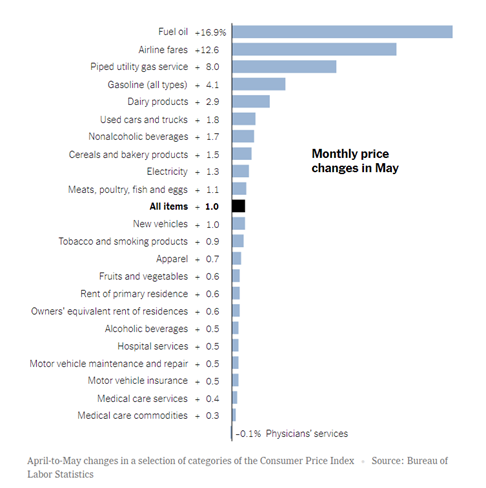

Inflation is measured as a change in the CPI (Consumer Price Index). The latest inflation report from the US Government indicates that, in aggregate, goods and services have increased in price by 8.6% in the last 12 months. Core inflation (excluding gas and food, which tend to fluctuate a lot) is up 6%.

Some items have increased in price more significantly than others: heating oil, airline fares, dairy products and used vehicles. Other items, such as medical services, auto repair and insurance, and fruit and vegetables have increased at lower rates.

Your Personal Inflation Rate

While the above statistics are informative, what is far more important to you, is how YOUR expenses have increased in the last 12 months. We think it is very prudent to answer the following two questions by following our recommended steps:

1. Determine how your expenses have changed: What’s your personal rate of inflation?

Use our Expense Worksheet to evaluate your current expenses line by line. Using your credit card and bank statements or budgeting software, the worksheet allows you to closely examine your current expenses and then further you can look at how some of these categories have likely increased over the past year to then determine your personal rate of inflation. Armed with this information, you can decide if you need to take any action, or rest knowing that you are still in a secure financial position and living within your means.

2. Based on how your expenses have increased, should you make any adjustments to your planning?

- You may not need to make adjustments to your planning, but simply being aware of the change in your expenses is a good exercise.

- Should you look to cut back in any expense category to further protect your finances and offset the impact of increased expenses?

- For retirees: Should you increase your withdrawal rate to compensate for higher expenses?

When we host our one-on-one client meetings this Fall, we will be talking about inflation and all of the above in more detail.