Do you have a dream of where you want to live during retirement? Maybe you want to move to a place with sun, warmth, and a beach during all four seasons? Perhaps you’re an avid hiker and biker and you dream of moving close to the mountains? Or perhaps, retirement is the perfect time to transform your travel bug into living abroad, enjoying a coffee and warm pastry in an international café each morning? Or you may think all that sounds nice, but you love your family and friends and want to stay put locally no matter how tumultuous the winters.

Regardless of where you choose to live in retirement, there are some important decisions to make concerning your residence. Retirement “by the book” says you should have your mortgage paid off prior to retiring, as this will provide you with lower monthly expenses and more stability. While there is certainly merit to this sound advice, we think it pays to do an objective analysis of owning versus renting.

OWNING

If you own a home, you have probably already considered many of the benefits to home ownership. You have an attachment to the place you raised your family. The walls speak to you. Your friends live nearby. You have stability.

The equity in your home can become a source of income, should you need it, with options such as a home equity line of credit. You have a valuable asset to leave your heirs, even if you spend down your savings in retirement. While insurance and taxes will increase, your mortgage will not and if you no longer have a mortgage then there’s no payment to begin with!

The Journal of Financial Planning reported that it takes three or fewer years to live in a home to reach the break even point where ownership makes more financial sense than renting, in most U.S. cities. This is based on costs such as the mortgage payment, down payment, rent, transaction costs, taxes, etc.

RENTING

On the other hand, recent research shows that under the new tax law the landscape is changing. Money magazine reported in March 2018 that a study by the Urban Institute found that under the Tax Cuts and Jobs Act of 2017, the monthly amount above which renters are better off becoming homeowners increased significantly for middle-class and wealthy taxpayers. Under the old rule for a typical three-person family earning $75,000, owning became more financially advantageous once the family’s monthly rent exceeded $893. Under the new tax law, that number climbs 14% to $1,017. For wealthy families, the difference can be even more dramatic. For a family making $300,000, the break-even rent jumps 32% from $2,757 a month to $3,631.

If we examine the rent-versus-buy decision from a financial perspective, it is a question of trade-offs and opportunity cost. By renting, you reduce your up-front expenses, preserve your liquid capital for other uses, and limit your exposure to maintenance costs. However, you also must abide by any rules or restrictions imposed by the property owner, for example, not allowing pets, permitting only certain colors of interior paint, or not allowing any changes to landscaping. Probably the biggest drawback of renting is not building home equity; rather renters enrich the property owner. However, if you’ve already paid off your mortgage you might be able to look at the numbers a little differently…

MOCK ANALYSIS

We get it, renting (yes being a tenant!) has a stigma to it, especially for those in retirement, however, the math can show a very different picture when we run through the numbers.

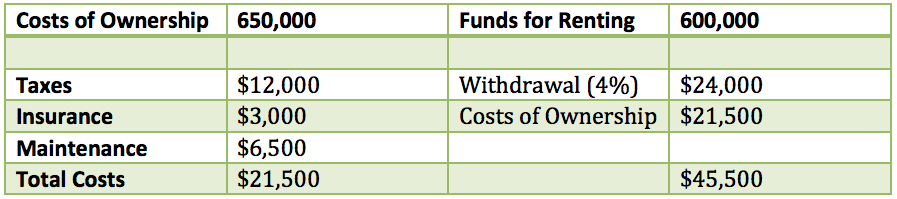

Let’s start with a numerical analysis of a homeowner couple with no mortgage who decides they want to rent instead. Their home is worth $650,000; they currently pay $12,000 per year in taxes and $3,000 for homeowner’s insurance. We will estimate 1% in annual maintenance costs – $6,500. Right now, this couple spends $21,500 per year to own their home. Let’s assume they decide to sell their house and rent instead. After realtor fees and transfer tax they net $600,000 and invest the proceeds in equities and bonds, choosing an appropriate asset allocation and rebalancing regularly – they determine they can safely withdraw 4% annually (and take annual inflationary raises to cover rent increases). They can take up to $24,000 out of their “home nest egg” the first year. That $24,000 plus the $21,500 they won’t be paying in home ownership expenses gives them $45,500 per year or nearly $3800 per month for a housing budget. If they choose to spend only $2800 on rent, that adds $1000 per month to their discretionary living expenses which may make it possible to further enrich their retirement by taking a vacation, joining a golf club, or flying more often to visit children and grandchildren who don’t live locally. Of course, they can also pocket that extra $12,000 per year (plus increases for inflation) for unexpected future expenses or to leave an inheritance to loved ones.

This is only one of countless scenarios. Perhaps your taxes are much lower, or you do not anticipate any major expenses. Or perhaps selling your house is not advantageous because a 4% withdrawal rate plus home ownership costs is not enough to cover rent for the kind of home you would like to live in. Regardless, these numbers are compelling enough to at least consider how renting rather than owning might bring flexibility and add cash flow to your retirement.

CREATE A LIST OF PROS AND CONS

We suggest coming up with your own analysis of pros and cons of owning versus renting and completing a mockup of your financial position depending on which you choose. Be sure to take into consideration other factors; such as determining property and income taxes for the state in which you plan to reside, costs of living in the city versus the suburbs or rural areas, etc. Or if that 55+ community is right for you, don’t forget about HOA and other fees you might incur in exchange for not needing to shell out cash for the external structure of your home, plowing snow, mowing the lawn, and maintaining the pool.

Of course, if creating a housing analysis spreadsheet doesn’t excite you, here at Stone Pine Financial we love running the numbers and are happy to help you determine which living situation is best for you.

Reach out to us anytime.