The Social Security Administration announced earlier this month the annual cost of living adjustment (COLA) will be a 1.6% increase. While this raise is lower than last year’s, the increase is tied to the consumer price index (CPI) which means inflation is currently low. This is typically a good thing. Low inflation boosts employment, makes it more likely the GDP will grow faster than inflation, also, the cost of borrowing money is lower which prompts people to spend more money and feed the economy. Hooray for low inflation and a low CPI! Right?

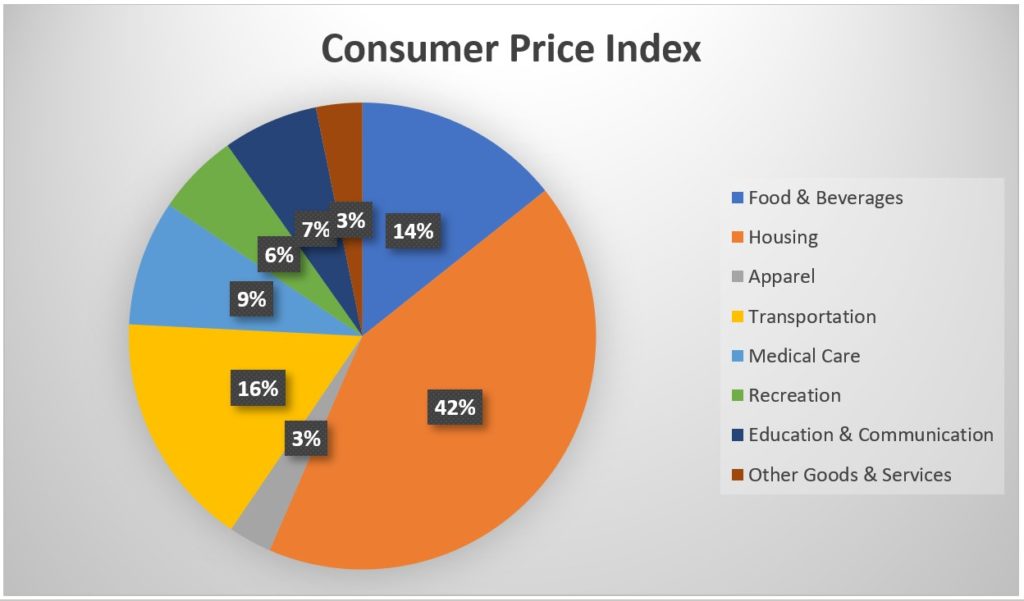

The CPI is a weighted average of goods and services. The chart below shows the 8 major categories and their overall percentage of influence on the CPI. Because it’s a weighted average, some items might have even lower inflation rates than the CPI, while other categories might be higher than average. This means your personal rate of inflation might be lower or higher than the CPI depending upon the basket of goods and services you actually use.

One of the items with higher than average inflation is medical care, which clocked in at a 4.4% increase over the past 12 months. While this number isn’t alarming by itself, what is concerning is when the proportion of healthcare in a budget is higher than average. Younger people tend to have fewer health care expenses and are therefore nominally impacted by the higher inflation rate. On the other hand, folks currently receiving Social Security typically have higher health care expenses and are therefore disproportionately affected by the increase in their expenses. For some folks, this means Social Security COLA increases may not be keeping up with their own personal inflation rate. Over time, this can put a significant strain on a budget. In fact, when looking at the purchasing power of Social Security for a typical recipient, it has actually decreased over time.

The CPI doesn’t tease out different populations to determine subsets of inflation, however, The Senior Citizens League (TSCL), a nonpartisan group that represents the interests of senior citizens, conducts a Social Security Loss of Buying Power Study. The study considers the weighted averages of goods and services used by senior citizens specifically, rather than the population as a whole like the CPI. TSCL’s 2018 results showed Social Security’s purchasing power had declined 34% since the year 2000.

So, what does this mean for you? This is just one more reason why strategically planning your investments can make or break your retirement budget. It’s also important to estimate your expected increases in health care costs as you age. Here at Stone Pine Financial we start with in depth conversations about your health and family history and couple that with sophisticated software analyses to provide you with an estimate of what to expect over time, and what to plan for. We then have a number of strategies to employ depending on your particular circumstances such as spending a little less now to save for expected health care costs in the future, or waiting to claim Social Security until full retirement age or later to maximize those guaranteed payments for when you’ll need them most. Whatever your needs, we have your back.